Law Firms And PEOs: Perfect Together

Law Firms And PEOs: Perfect Together

Cary Edwards, managing partner of Edwards & Caldwell in Hawthorne, NJ, says, “My PEO provides my staff and me with Fortune 500 benefits and services while handling all the employee-related paperwork. It’s a very cost-effective management tool for small and mid-sized firms.”

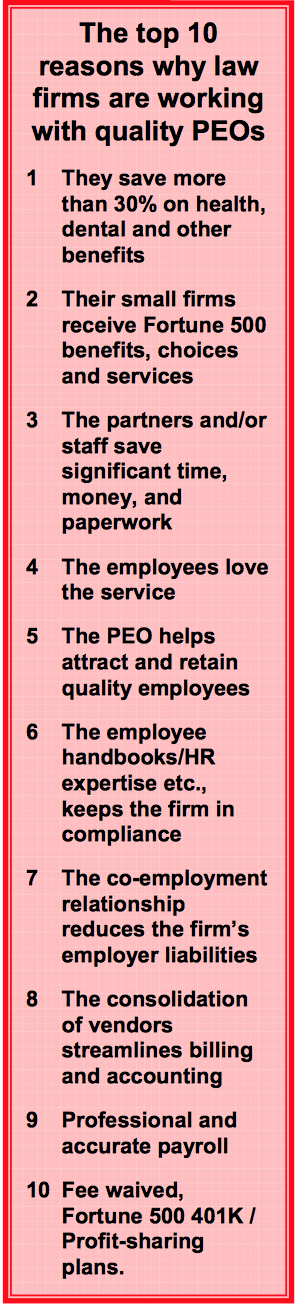

Professional Employer Organizations, or “PEOs” as they are commonly known, have become extremely popular with small to mid-sized businesses throughout the country. PEOs work particularly well for professional firms, where revenues are directly tied to a professional’s time. In addition to providing Fortune 500 human resources benefits and services, PEOs significantly lower employer liabilities through a co-employment relationship. PEOs, which aggregate thousands of local employees together, work equally well with limited liability companies, limited liability partnerships, “S” Corps. or “C” Corps. From senior partners to receptionists, everyone benefits from the co-employment arrangement. Partners have the convenience of becoming a W-2 employee of the PEO (thereby qualifying parties for pre-tax benefits and reducing paperwork), while retaining full ownership of their practice.

The law firm retains complete control over its employee, retaining the right to hire, fire, and set salaries, among other things. The PEO simply becomes the administrative employer, i.e., the employer responsible for processing payroll, providing benefits and filing all legal papers for the employees. A PEO serves as the law firm’s off-site Human Resources Department. Co- employment is a dynamic concept that’s changing the way small firms do business.

Partners of small and mid-sized law firms wear many different hats. One very serious, time- consuming hat always worn is the role of employer. Law firms with 5 to 100 employees are discovering that PEOs not only provide wholesale rates on comprehensive health benefits packages (the dollar savings can be substantial), but save the partner/owner and their administrative staff from the mundane paperwork and constant queries associated with employees. Even if your firm has a full staff of administrators, a PEO adds additional value, especially if the PEO works for “free.” It is not uncommon for the PEO to pay for itself based on a “hard dollar” analysis where the savings for an upgraded benefits package will more than cover the PEO service fee, allowing your staff to work on more revenue producing tasks such as marketing or the collection of accounts receivable. This is the upside to working with a quality PEO.

“The PEO has played an integral role in the success of my practice. The PEO saves my staff time and keeps my people happy. They provide my firm with a cafeteria-style benefits package that rivals that of the local multi-billion dollar conglomerates,” says Jesse Sheffet, Esq., senior partner of his South Plainfield, NJ firm. “My PEO provides me with a customized employee handbook, flex-spending plan, fee-waived 401k plan and multiple health plans for each and every employee to choose from…it costs me nothing and they are legally responsible for all the paperwork. When an employee or spouse has a specific question about their health plan or wants to change their direct deposit, they just call the PEO. I recommend them to all my clients and colleagues.”

When choosing a PEO…

The PEO is an excellent management tool when delivered effectively. When hiring a PEO make certain that they are capable of handling your employees’ needs. Many national PEOs boast tens of thousands employees but they may be mostly comprised of fast-food chains and fix-it shops. The questions and concerns of a part-time waiter will differ from that of your junior partner and his family. Make certain to ask for a long list of local references from other professional firms.

For more information on how PEO Brokers of America can help provide your company with better benefits, perks and discounts, and a better HR infrastructure, contact us today!

888.370.5406

info@peoboa.com